Kula Chief Executive Officer Ric Dawson said:

““What an amazing time to join the Company and work on such a suite of projects as the Brunswick and Kirup Projects in near jurisdiction to the substantial Greenbushes Mine.

We are delighted to acquire a significant majority stake in a highly prospective lithium project in a world-renowned lithium district and increase our existing lithium exploration ground at Greenbushes in Western Australia.

We have secured an outstanding exploration opportunity near our existing Brunswick Project to add to our existing portfolio of assets in Western Australia. We will proceed to exploring these tenements in a methodological step-by-step manner.

We are pleased to joint venture with Sentinel Exploration Ltd and look forward to updating the market with our developments in due course.”

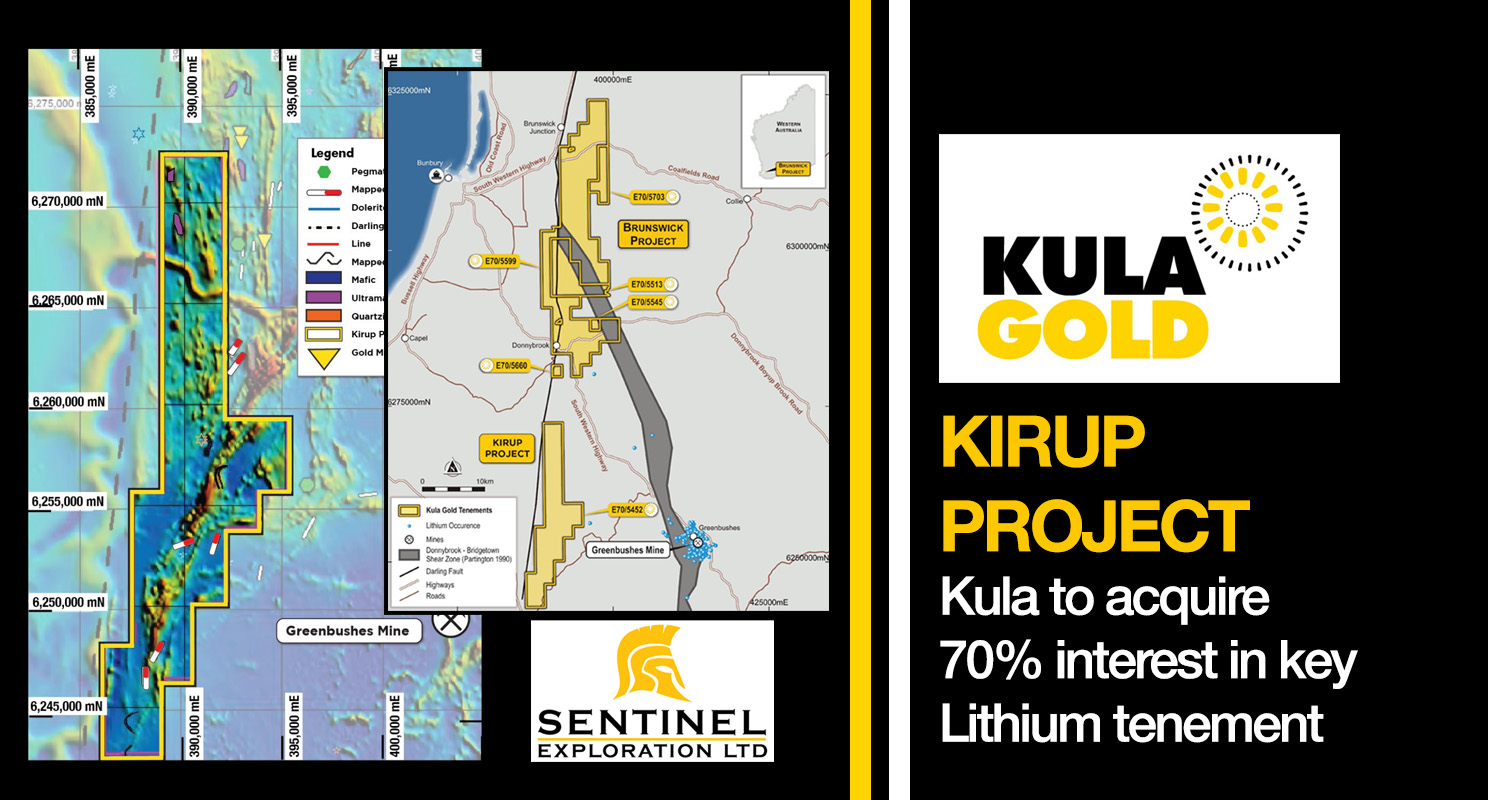

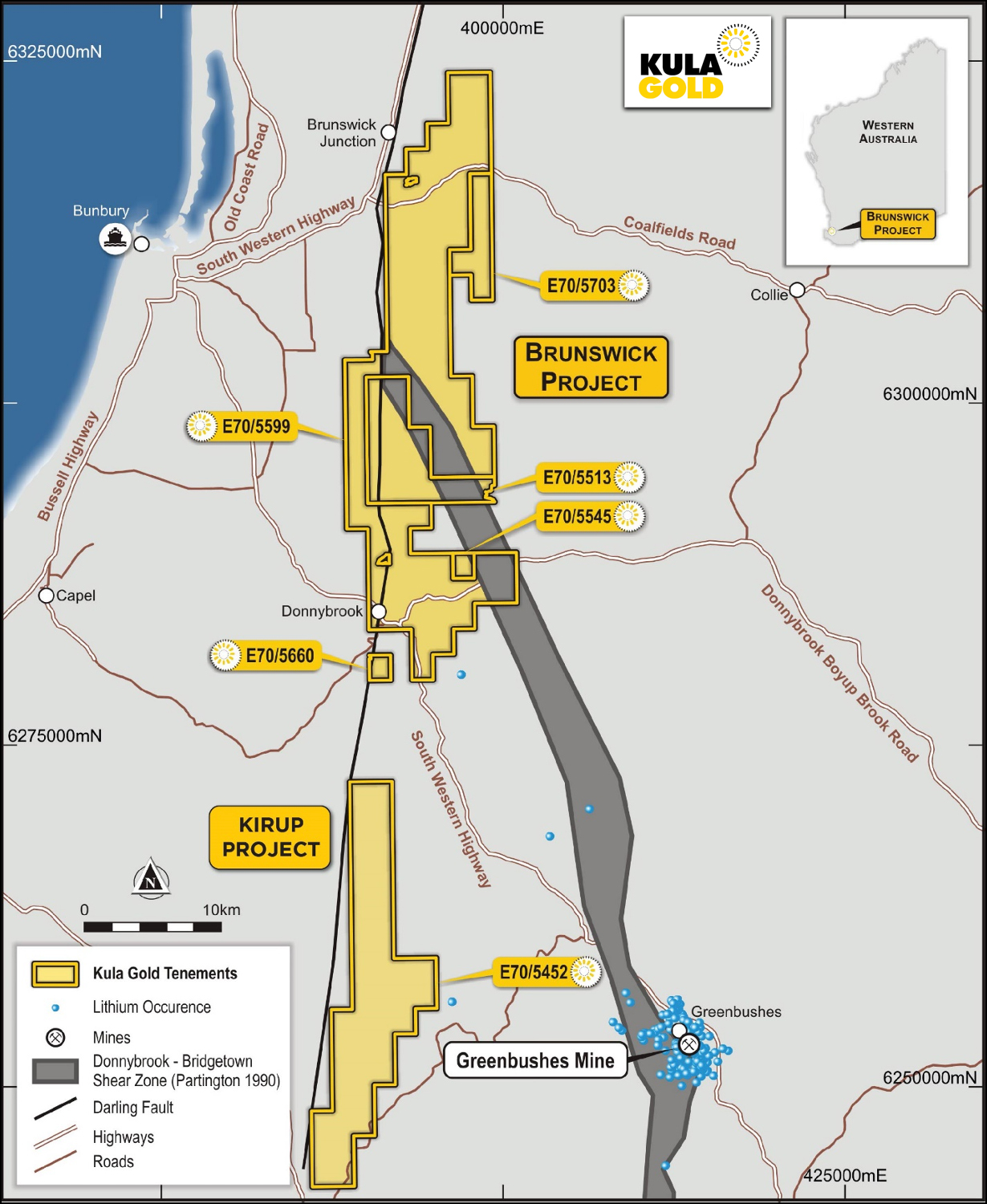

Figure 1: Kula’s Kirup and Brunswick Projects, the DBSZ and proximity to Greenbushes Mine and infrastructure in WA.

HIGHLIGHTS [View PDF]

- Kula has entered into an agreement to acquire a 70% interest (subject to the completion of satisfactory due diligence, shareholder and other regulatory approvals) in the lithium and related minerals in a key tenement to complement the existing Brunswick Project.

- The Kirup Project has an area of 117km2 and located within 25km of the world class Greenbushes Lithium Mine.

- The Company is well funded to commence exploration activities on the multiple pegmatites already mapped within the tenement.

- The purchase price includes a cash reimbursement of exploration expenditure of $200,000, 12m fully paid ordinary shares and $2m in fully paid ordinary shares upon announcing a JORC maiden resource on the Kirup Project of a minimum of 10mt of ore at a grade of 1% lithium or greater.

About Kirup Project

The Kirup Project is located 200km South of Perth, the capital of Western Australia. With an area of 117km2, the Project was originally acquired by Merchant Ventures Pty Ltd, now a wholly owned subsidiary of Sentinel Exploration Ltd due to the proximity to the Greenbushes Lithium Mine and the numerous geological mapping and mineral occurrences and geophysical structures. The Project area commences approximately 25km West of the Greenbushes open pit mining operation (Figure 1).

Greenbushes is currently the largest hard-rock lithium mine in the world, operating since May 2014 by Talison Lithium Pty Ltd, an incorporated joint venture between Tianqi Lithium Corporation (51%) and Albemarie Corporation (49%). Greenbushes produces a concentrate of the lithium mineral, spodumene, to feed both China and Western Australia based mineral conversion plants or consumers of spodumene concentrates in Europe, North America and China. Australian mining company IGO Limited recently signed a deal to acquire a 24.99% stake in Greenbushes from Tianqi Lithium Corporation.

Reports of work by earlier explorers and the Geological Survey of Western Australia* within the Project record the presence of pegmatites – a rock that may host spodumene – and so provides immediate exploration targets. Much of this earlier work focused on the discovery of the minerals cassiterite (tin) and tantalite (tantalum), as Greenbushes was at different times mining for these minerals before spodumene (lithium) became the major driver of revenue.

Recent data review by Sentinel Exploration Ltd has involved desktop reviews of all available WAMEX historical reports as per Table 1 and 2 and georeferencing maps, collating geochemical, all augur, percussion/reverse circulation (RC) and diamond core drilling data into modern GIS format and, collating all historical geophysical data.

A prospectively target map has been created following both geological and geophysical interpretation from the data preparation, collation and review and is ready to start field work early in the new year upon settlement of the purchase agreement.

Minimal field work has been carried out until this precursory technical review had been performed.

Planned future work on the Kirup Project includes detailed and targeted pegmatite mapping and geochemical sampling over all the accessible pegmatites from the historical mapping a well as part of the due diligence process verification of historical mapped pegmatites.

Targets from geochemistry anomalies and possibly the planned geophysical survey and will then be priority ranked for drill testing.

Plans are proceeding to securing and targeting a new low-level magnetics and radiometric surveys, quotes have been requested and subject to availability and awaiting the purchase agreement being approved before agreeing to proceed subject to acceptable terms.

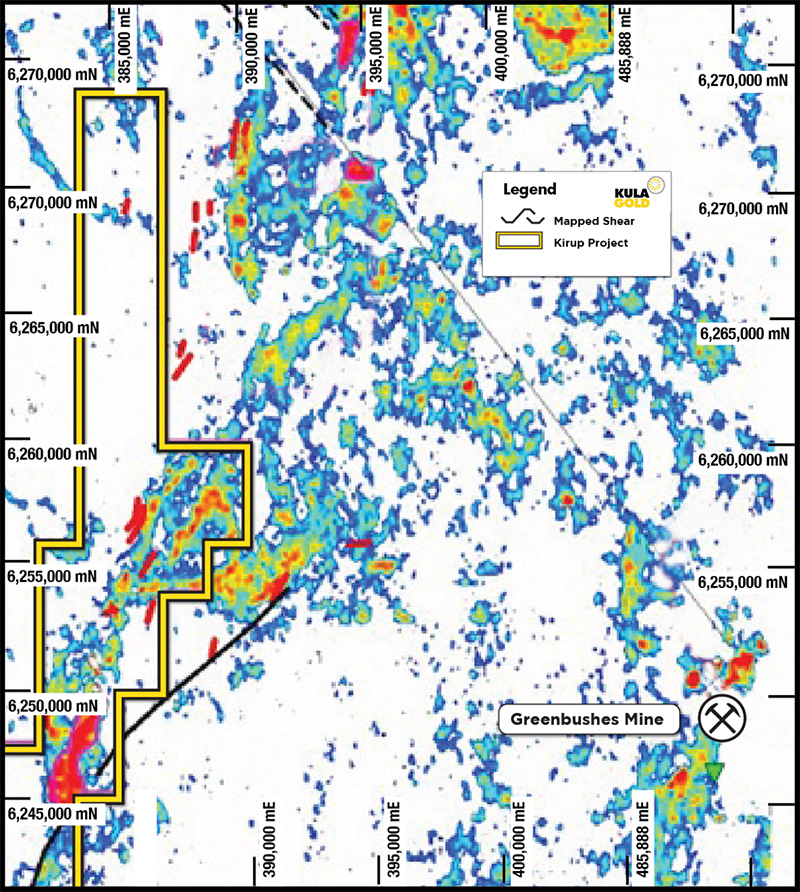

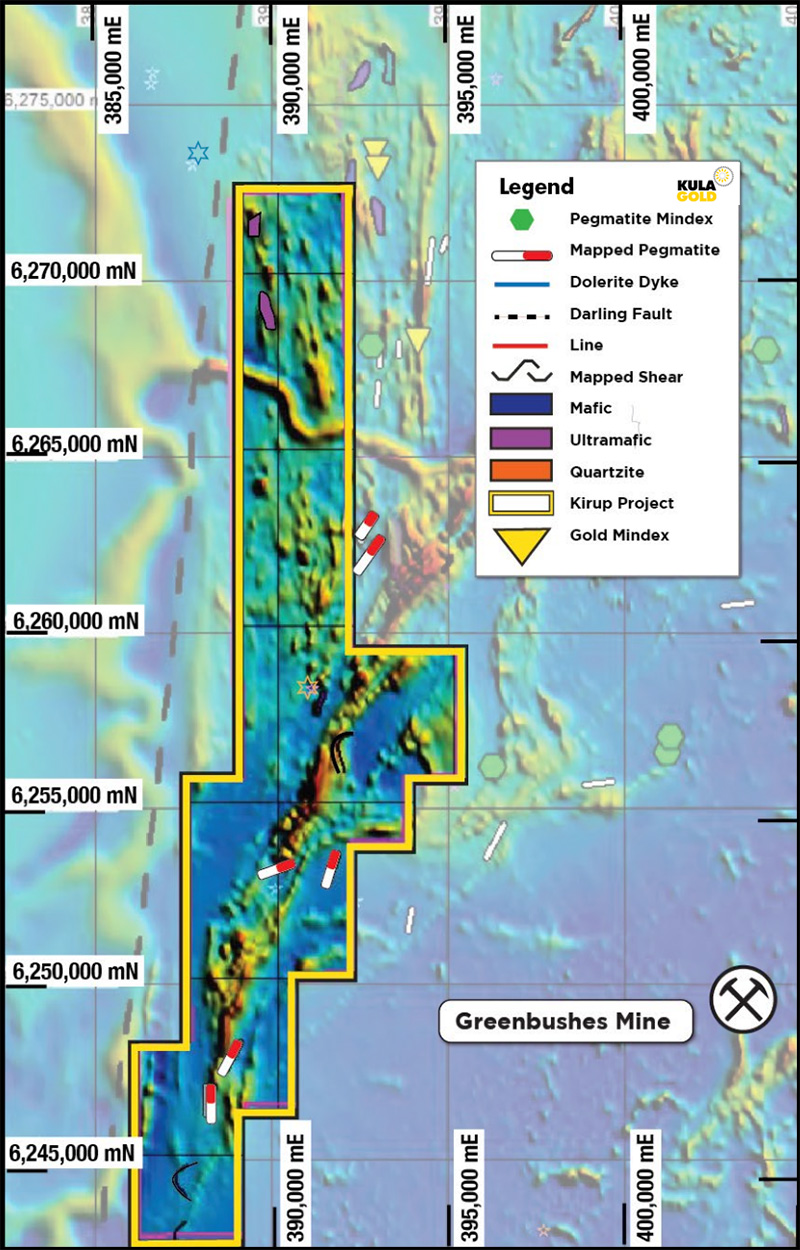

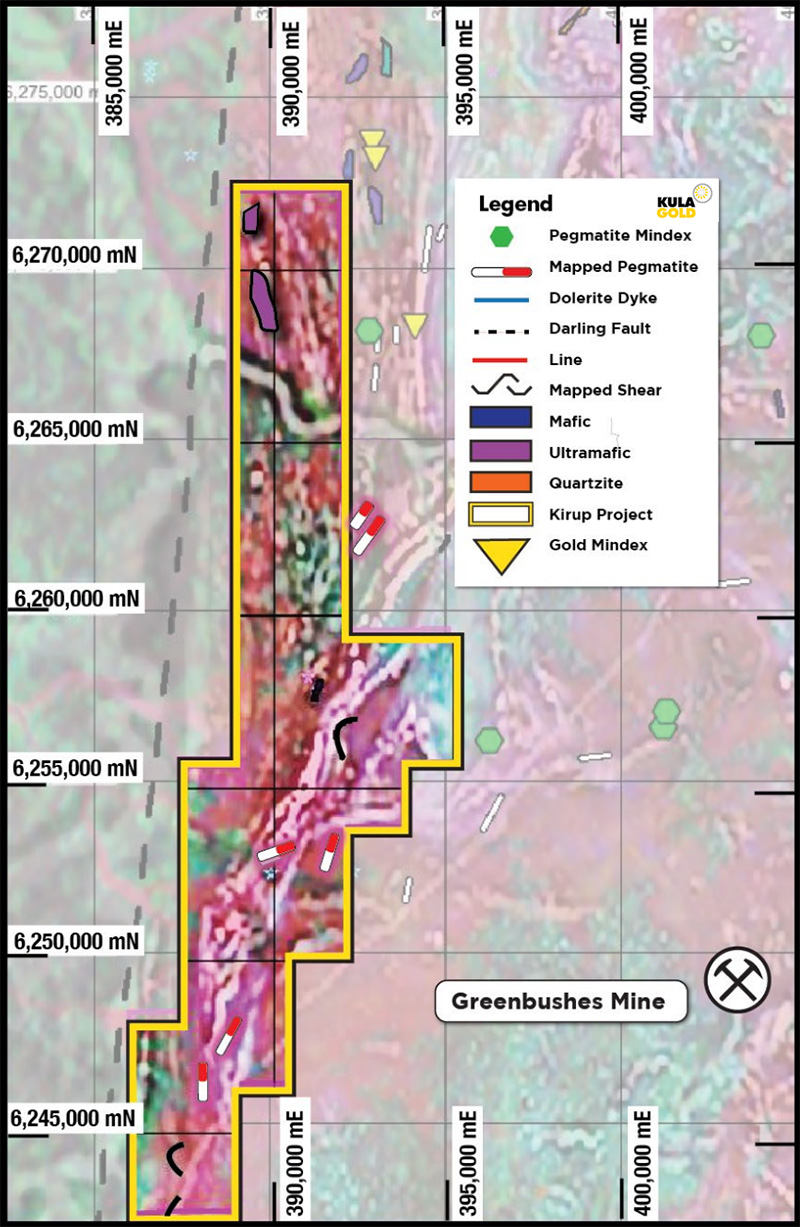

As noted above in Figure 2, the very strong anomalous signature (red) and shear around the Greenbushes Mine provides a good target for Kula’s technical team to explore the similar strong anomalous signature (red) and shear in the acquisition tenement. The U2/Th ratio map above also highlights the Donnybrook-Bridgetown Shear Zone and note the structural juxtaposition of Pegmatites (red on this map) to the fault in the new Kirup Project tenement and the Greenbushes Lithium Mine.

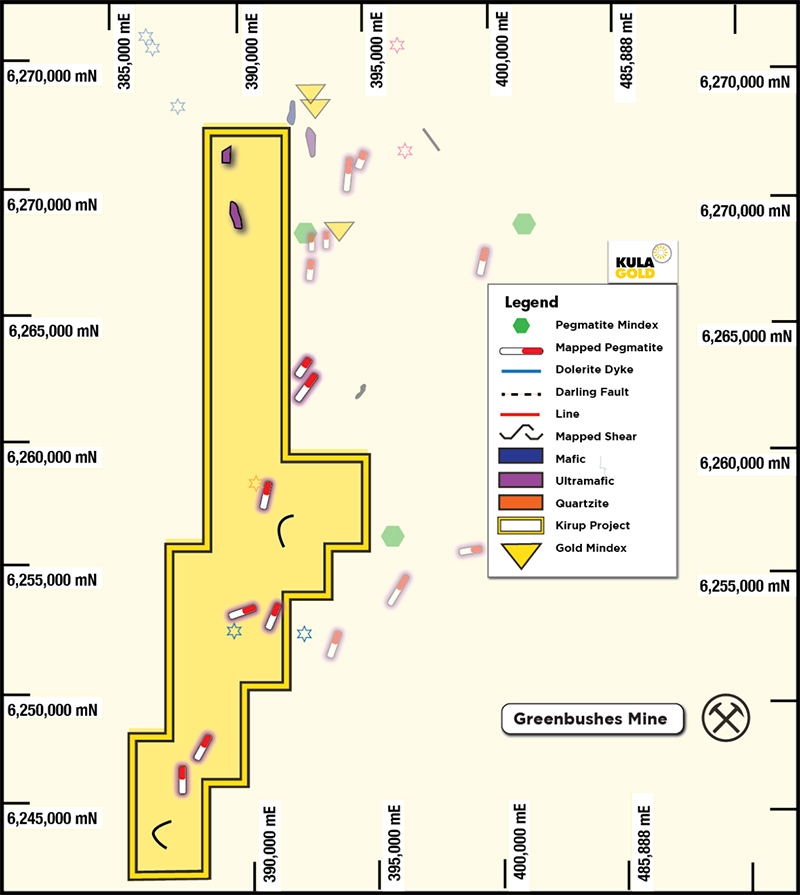

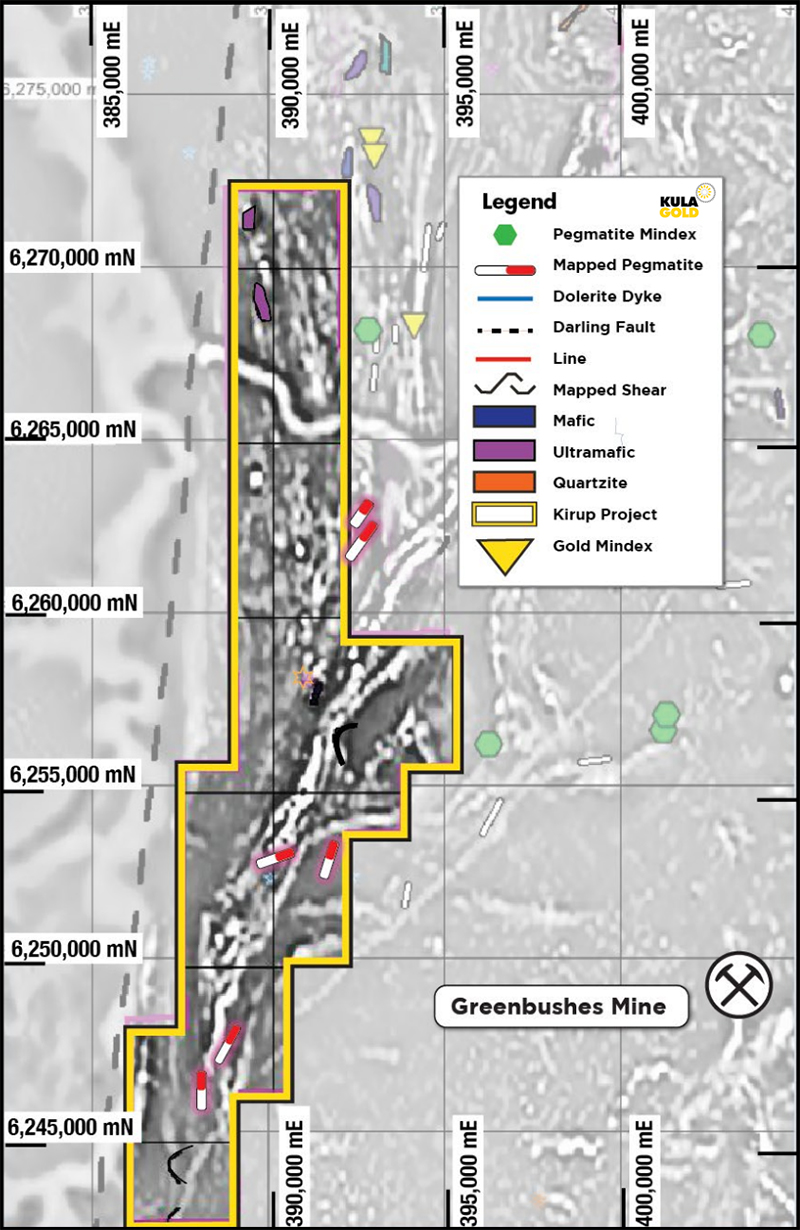

As noted above in Figure 3, the mapped pegmatites provide a good target for Kula’s technical team to explore in the acquisition tenement.

Figure 4: RTP Magnetics overlaid by the Geological highlights from the GSWA 1:250k Collie Geological Map.

Figure 5: RTP 1 VD Magnetics overlaid by the Geological highlights from the GSWA 1:250k Collie Geological Map.

As noted above in Figures 4 and 5, the very strong magnetic signature and mapped pegmatites provides a good target for Kula’s technical team to explore both lithium suite (LCT) mineralisation.

Figure 6: KThU RG8 image overlaid by the Geological highlights from the GSWA 1:250k Collie Geological Map

As noted above in Figure 6, the anomalous KThU signature (pink) around the Greenbushes Mine provides a good target for Kula’s technical team to explore the similar anomalous KTHU signature (pink) in the acquisition tenement.

The Company is well funded to commence due diligence explorational activities and will announce results and progress in due course.

- Kula has entered into a binding term sheet (“Agreement”) with Sentinel Exploration Ltd (“Sentinel”) (ACN 644 425 678), an Australian public unlisted company that holds the Kirup Project. Director Mark Stowell and former Director Simon Adams are Directors of Sentinel and collectively hold approximately 37.59% of its issued capital, and as a result the ASX has determined that Sentinel is a related party for the purposes of Chapter 10 of the Listing Rules.

The key terms of the Agreement are:

Kula to acquire a 70% interest in the Lithium Rights1 in the Kirup Project, tenement E70/5452;

The acquisition is conditional upon the following being satisfied by no later than 31 March 2023:

-

- Kula completing due diligence to its satisfaction;

- Kula obtaining all approvals under the Listing Rules for the acquisition (including approval by ASX for the terms of the deferred consideration);

- Sentinel acquiring all of the issued share capital of Merchant Ventures Pty Ltd; and

- the parties obtaining all approvals required under the Mining Act.

Kula to:

- Pay $70,000 upon singing the Agreement and $130,000 upon completing the acquisition for reimbursement of exploration expenditure costs incurred to date by Sentinel. The exploration expenditure incurred to date includes tenement acquisition costs, rates, rent, tenement management costs, geology consultants review of historical data and numerous site visits collecting samples. These samples have been sent to the lab for assays, results of which will be reported in due course;

- Issue 12,000,000 fully paid ordinary shares. As a result of ASX Listing Rule 10.7, these shares will be subject to a 12-month escrow period from the date of issue.

- Pay $2m payable in fully paid ordinary shares issued at the 10-day VWAP (commencing upon announcing the resource), with a minimum issue price of $0.04 on completion of a JORC maiden inferred resource on the Kirup Project of a minimum of 10mt of ore at a grade of 1% lithium (or metal equivalent) or greater within 5 years of the Lithium Rights being acquired As a result of ASX Listing Rule 10.7, these securities will be subject to a 12-month escrow period from the date of issue.

- Free carried exploration for Sentinel for its 30% interest in the Kirup Project to the completion of an economic Feasibility Study viable for bank finance.

- The term sheet contains warranties typical for a transaction of this nature.

1 Lithium Rights as defined by the Agreement to be containing the elements Lithium, Tin, Tantalum, Scandium, Caesium, Gallium, Niobium, Yttrium, Tungsten, Rubidium and the Total Rare Earth Oxides.

Kula is currently preparing the material for a shareholder meeting to approve the transaction (including obtaining an independent expert’s report opining on the fairness and reasonableness of the acquisition) and anticipates the meeting to be held in March 2023.

This ASX announcement has been authorised by the Board of Kula Gold Limited.

News Release

Date: xx Month 2022 | ASX Code: KGD

Competent Person Statement

The information in this report that relates to geology and exploration is based on information compiled by Mr. Ric Dawson, a Competent Person who is a member of the Australian Institute of Mining and Metallurgy. Mr. Dawson is a Geology and Exploration Consultant who has been engaged by Kula Gold Limited. Mr. Dawson has sufficient experience, which is relevant to the style of mineralisation, geology and type of deposit under consideration and to the activity being undertaken to qualify as a competent person under the 2012 edition of the Australasian Code for Reporting Exploration Results, Mineral Resources and Ore Reserves (the 2012 JORC Code). Mr. Dawson consents to the inclusion in the report of the matters based on her information in the form and context in which it appears.

About the Company

Kula Gold Limited (ASX: KGD) is a Western Australian mineral exploration company with expertise in the discovery of new mineral deposits in WA. The strategy is via large land positions and structural geological settings capable of hosting ~+1m oz gold or equivalent sized deposits including Lithium.

The Company is advancing projects within the South West region of WA for Lithium and Gold at Brunswick and Kirup, as well as Gold and PGE at Westonia adjacent to the producing Edna May Gold Mine (owned by ASX:RMS) in the WA goldfields.

The Company has a history of large resource discoveries with its foundation being the Woodlark Island Gold project in PNG, (+1m oz Gold) which was subsequently joint ventured and sold to (ASX: GPR).

Kula’s recent discovery was the large 93.3mt Boomerang Kaolin deposit near Southern Cross WA– Maiden resource announced 20 July 2022. This project is in the economic study phase and moving to PE funding or trade JV.

The exploration team are busily working towards the next mineral discovery, potentially Lithium near the world class Greenbushes Lithium Mine.

Contact the Company Secretary for more information – +61(08) 6144 0592 or cosec@kulagold.com.au